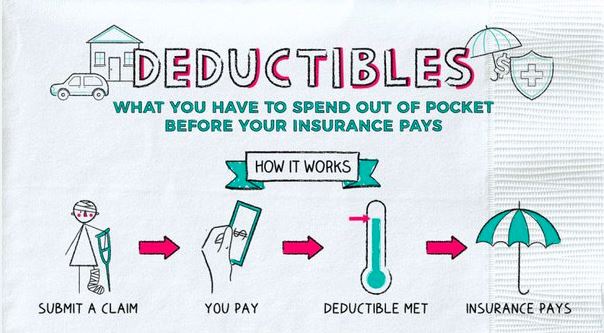

When purchasing insurance, whether it be for health, auto, homeowners, or another type of policy, understanding deductibles is crucial. A deductible is the amount you are required to pay out-of-pocket before your insurance coverage kicks in. The role of deductibles can significantly impact both your premium costs and your financial responsibilities in the event of a claim. Here’s a detailed exploration of how deductibles work and their importance in insurance policies.

The Role of Deductibles in Insurance Policies

#1. Understanding Deductibles

A deductible is a predetermined amount specified in your insurance policy. For instance, if you have a health insurance policy with a $1,000 deductible, you must pay the first $1,000 of your medical expenses before your insurance begins covering costs. Deductibles can apply to various types of insurance, including:

– Health Insurance: Costs related to medical care that must be paid by the insured before benefits are paid.

– Auto Insurance: The amount you pay out of pocket for repairs or damages after an accident.

– Homeowners Insurance: The deductible applied when filing a claim for damages to your home or belongings.

#2. Types of Deductibles

Deductibles can vary widely, depending on the type of insurance and the specifics of your policy:

– Fixed Deductible: A set amount that must be paid before insurance coverage begins. For instance, if you have a $500 deductible, you’ll always pay that amount before your insurance covers the rest.

– Percentage Deductible: Seen often in homeowners insurance, this type is based on a percentage of the total insured value. For example, if your home is valued at $200,000 with a 1% deductible, you would need to pay $2,000 out of pocket before the insurer pays for damages.

– Variable Deductible: Some policies allow you to choose your deductible from a range of options, often affecting the premium cost. Higher deductibles usually result in lower monthly premiums and vice versa.

#3. Impact of Deductibles on Premiums

One of the primary reasons insurance companies offer different deductible amounts is the impact on insurance premiums. Deductibles function as a cost-sharing mechanism between the insured and the insurer:

– Higher Deductibles, Lower Premiums: Choosing a higher deductible can lower your monthly or annual premium payments. This might be a good option for those who are financially secure and can afford to pay a larger amount out-of-pocket in case of a claim.

– Lower Deductibles, Higher Premiums: Conversely, a lower deductible leads to higher premiums. This may be suitable for individuals who want to minimize out-of-pocket costs when filing claims, especially if they anticipate frequent claims.

#4. Encouraging Responsible Behavior

Deductibles can also encourage responsible behavior among policyholders. When individuals know they have to pay a certain amount before insurance coverage begins, they may be more cautious regarding claims. This can lead to:

– Reduced Claims: By discouraging minor claims, deductibles help keep claims costs down, which can ultimately lead to lower premiums for all policyholders.

– Proactive Risk Management: Knowing you will bear part of the cost may motivate you to take better care of your insured items, such as maintaining your vehicle or adequately protecting your home.

#5. Considerations When Choosing a Deductible

When selecting a deductible, consider several factors:

– Financial Situation: Assess your ability to pay the deductible amount in case of a claim. Choose a deductible that aligns with your unique financial situation and comfort level.

– Claim Frequency: Consider how often you may need to file a claim. If you anticipate regular claims, a lower deductible may provide peace of mind despite higher premiums.

– Total Insured Value: In cases like homeowners insurance, where a percentage deductible is used, evaluate the total value of your property and what a percentage-based deductible might mean financially.

– Long-term Costs: Balance premium costs against potential out-of-pocket expenses. Sometimes, saving a little on premiums may lead to significant costs if claims become necessary.

#Conclusion

Deductibles are a fundamental aspect of insurance policies that play a critical role in determining your financial responsibility and premium costs. Understanding how they work can help you make informed decisions based on your unique circumstances and insurance needs. Whether it’s finding the right balance between your monthly premium and potential out-of-pocket expenses, or simply understanding the implications of your deductible choices, knowledge of this aspect of insurance can pave the way for better financial planning and risk management.