An Individual Retirement Account (IRA) is an essential tool for building a secure financial future and maximizing retirement savings. Whether you have a Traditional IRA or a Roth IRA, there are strategic approaches you can adopt to make the most of your contributions and ensure a comfortable retirement. In this blog post, we will explore key strategies for maximizing your IRA and setting yourself up for a financially secure retirement.

Maximizing Your IRA: Strategies for Retirement Savings

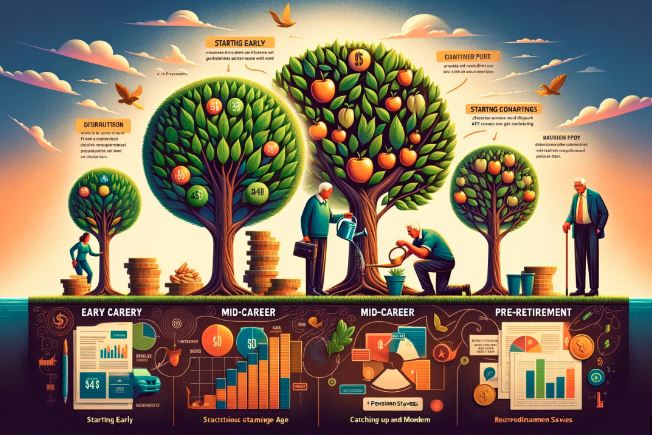

- Start Early and Contribute Regularly:

Time is your greatest asset when it comes to retirement savings. Start contributing to your IRA as early as possible and make regular contributions. Even small amounts consistently invested over time can grow significantly due to compound interest. Take advantage of the power of compounding by making contributions a priority.

- Maximize Annual Contributions:

Make an effort to maximize your annual contributions. As of 2021, the annual contribution limit for Traditional and Roth IRAs is $6,000, with an additional $1,000 “catch-up” contribution allowed for individuals aged 50 and older. Contribute the maximum amount if your financial situation allows for it, as this will help maximize your tax benefits and long-term growth potential.

- Consider Roth vs Traditional IRA:

Understand the differences between a Roth IRA and a Traditional IRA to determine which is more suitable for your financial goals. Roth IRAs offer tax-free withdrawals in retirement, whereas contributions to a Traditional IRA are tax-deductible. Consider factors such as your current and expected future tax brackets, as well as your long-term financial goals, when deciding which type of IRA to contribute to.

- Diversify Your Investments:

To maximize the potential returns of your IRA, ensure that your investment portfolio is properly diversified. Spread your investments across a range of asset classes, such as stocks, bonds, and mutual funds, to mitigate risk and potentially increase returns. Regularly review and rebalance your portfolio to maintain proper diversification and align with your risk tolerance.

- Take Advantage of Employer Matches:

If your employer offers a 401(k) or similar retirement plan with matching contributions, contribute enough to receive the maximum match. Employer matches are essentially free money and can significantly boost your retirement savings. Prioritize contributing to your employer-sponsored plan before considering further contributions to your IRA.

- Consider Tax Strategies:

Explore potential tax strategies to optimize your IRA contributions. For example, if you qualify for a deduction for Traditional IRA contributions, contributing may reduce your taxable income for the year, potentially resulting in tax savings. Consult with a financial advisor or tax professional to determine the most advantageous tax strategies based on your specific circumstances.

- Regularly Review and Adjust:

Continuously monitor and assess your IRA’s performance, your financial goals, and any changes in your circumstances. Adjust your contributions and investment allocations accordingly. Regular reviews will help ensure that your IRA remains aligned with your retirement objectives and that you are on track to achieve your savings goals.

Conclusion:

Maximizing your IRA is essential for securing a comfortable retirement. By starting early, maximizing contributions, diversifying investments, considering tax strategies, taking advantage of employer matches, and regularly reviewing and adjusting your strategy, you can make the most of your IRA savings and optimize your path towards financial security in retirement. Remember, consulting with a financial advisor can provide personalized guidance based on your unique circumstances and goals. Start implementing these strategies today and embark on a journey towards a financially rewarding retirement.