Investing in index funds can be a strategic approach for long-term growth, offering broad market exposure, diversification, and cost-efficiency. Here’s a step-by-step guide to help you invest in index funds effectively:

How to Invest in Index Funds for Long-Term Growth

1. Understand Index Funds

1.1. What Are Index Funds?

- Definition: Index funds are mutual funds or exchange-traded funds (ETFs) designed to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average.

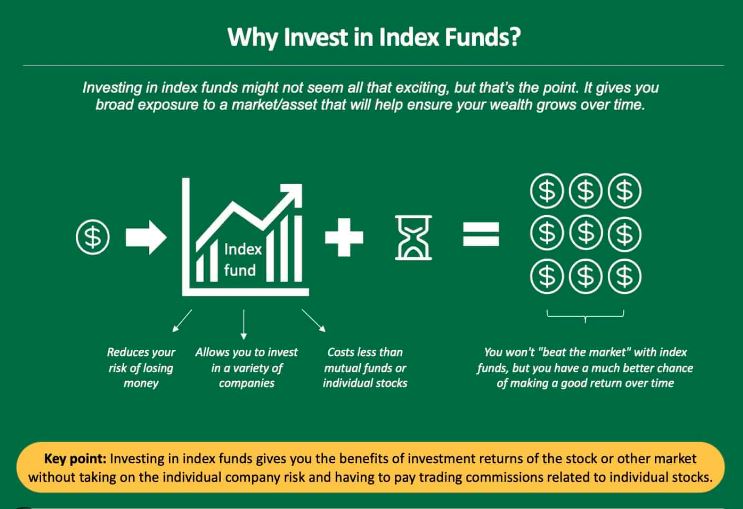

- Objective: The goal of an index fund is to replicate the performance of its benchmark index by holding the same stocks or assets in proportion to the index.

1.2. Benefits of Index Funds

- Diversification: Index funds provide exposure to a wide range of stocks or assets, reducing the risk associated with investing in individual securities.

- Low Costs: They generally have lower management fees compared to actively managed funds due to their passive investment strategy.

- Consistent Performance: By tracking an index, these funds aim to deliver returns that are closely aligned with the overall market or sector performance.

2. Determine Your Investment Goals

2.1. Define Your Objectives

- Time Horizon: Consider your investment time horizon, which could range from several years to decades. Index funds are well-suited for long-term growth due to their broad market exposure.

- Risk Tolerance: Assess your risk tolerance to determine the appropriate index funds. Higher-risk indices, such as those focused on small-cap stocks, may offer higher potential returns but with greater volatility.

2.2. Set Financial Goals

- Retirement: Index funds are a popular choice for retirement accounts, such as 401(k)s or IRAs, due to their growth potential and low fees.

- Other Goals: You can also use index funds for other long-term financial goals, such as saving for education, a home purchase, or wealth accumulation.

3. Choose the Right Index Funds

3.1. Research Indexes

- Major Indices: Familiarize yourself with major indices, such as the S&P 500, NASDAQ-100, and Russell 2000. Each index has a different focus, such as large-cap stocks, technology companies, or small-cap stocks.

- Sector and Regional Indices: Consider sector-specific or regional indices if you want to target specific areas of the market, such as international markets or technology sectors.

3.2. Evaluate Index Funds

- Expense Ratios: Compare expense ratios, which represent the fund’s annual operating expenses as a percentage of assets. Lower expense ratios are generally more cost-effective.

- Tracking Error: Review the fund’s tracking error, which measures how closely the fund’s performance matches its benchmark index. A lower tracking error indicates better tracking accuracy.

- Fund Size and Liquidity: Consider the fund’s size and liquidity. Larger funds with higher liquidity may offer better trading conditions and lower bid-ask spreads.

4. Open an Investment Account

4.1. Choose a Brokerage or Investment Platform

- Brokerage Accounts: Open a brokerage account with a firm that offers a range of index funds and ETFs. Many online brokerages provide access to low-cost index funds and user-friendly platforms.

- Retirement Accounts: If investing for retirement, open an IRA or utilize an employer-sponsored 401(k) plan. Some retirement accounts offer a selection of index funds within their investment options.

4.2. Account Types

- Taxable Accounts: Standard brokerage accounts where you can invest in index funds with tax implications on capital gains and dividends.

- Tax-Advantaged Accounts: Retirement accounts like IRAs and 401(k)s offer tax benefits, such as tax-deferred growth or tax-free withdrawals, depending on the account type.

5. Invest and Monitor

5.1. Make Your Investment

- Initial Investment: Decide on the amount to invest in index funds based on your financial goals and risk tolerance. Many funds have minimum investment requirements.

- Dollar-Cost Averaging: Consider using dollar-cost averaging, which involves investing a fixed amount of money at regular intervals. This strategy can reduce the impact of market volatility and lower the average cost per share.

5.2. Monitor Performance

- Review Periodically: Regularly review your index fund investments to ensure they align with your financial goals and risk tolerance. Monitor performance against the benchmark index and make adjustments as needed.

- Rebalance Portfolio: Periodically rebalance your investment portfolio to maintain your desired asset allocation. This may involve adjusting the proportion of index funds or other investments in your portfolio.

6. Stay Informed and Adapt

6.1. Market Trends and News

- Stay Updated: Keep abreast of market trends, economic news, and changes in index fund performance. Staying informed helps you make informed investment decisions and adjust your strategy if necessary.

- Educational Resources: Utilize resources such as financial news websites, investment blogs, and educational materials provided by brokerages or investment platforms.

6.2. Review and Adjust Strategy

- Periodic Review: Regularly review your investment strategy and goals. As your financial situation or objectives change, adjust your index fund investments accordingly.

- Seek Professional Advice: Consider consulting a financial advisor for personalized guidance and recommendations based on your specific investment needs and goals.

Conclusion

Investing in index funds can be an effective strategy for long-term growth, offering diversification, low costs, and consistent performance. By defining your investment goals, selecting the right index funds, and staying informed, you can build a solid foundation for achieving your financial objectives. With patience and a disciplined approach, index funds can help you achieve sustainable growth and build wealth over time.