Dollar-Cost Averaging (DCA) is a popular investment strategy that involves regularly investing a fixed amount of money into a particular asset or portfolio at predetermined intervals, regardless of market conditions. This approach can offer several benefits, particularly for long-term investors. Here’s a detailed look at the advantages of Dollar-Cost Averaging:

The Benefits of Dollar-Cost Averaging in Investing

1. Mitigates Market Timing Risk

1.1. Reduces Impact of Market Volatility

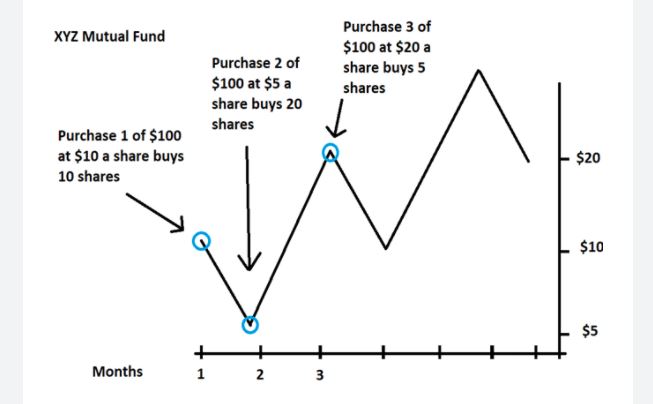

- Consistent Investment: By investing a fixed amount at regular intervals, you reduce the risk of investing a large sum at an inopportune time, such as during a market peak.

- Averaging Out Costs: DCA helps to smooth out the effects of market fluctuations, as you buy more shares when prices are low and fewer shares when prices are high.

1.2. Avoids Timing Errors

- Less Need for Market Predictions: DCA eliminates the need to predict market movements or time your investments precisely. This can be particularly beneficial for investors who may struggle with market timing or who are uncertain about short-term market trends.

2. Encourages Disciplined Investing

2.1. Promotes Regular Investment Habits

- Systematic Approach: DCA fosters a disciplined investing habit by encouraging you to invest regularly, regardless of market conditions. This systematic approach helps build wealth over time.

- Avoids Emotional Decisions: Regular investments can help reduce the impact of emotional decision-making, as you follow a pre-determined plan rather than reacting to market highs and lows.

2.2. Simple and Easy to Implement

- Automated Investments: Many investment platforms and brokerages offer automatic investment plans that facilitate DCA, making it easy to implement without constant attention or manual intervention.

- Low Maintenance: Once set up, DCA requires minimal effort, allowing you to focus on other aspects of your financial strategy.

3. Helps Manage Investment Risks

3.1. Reduces Risk of Lump-Sum Investing

- Avoids Large Losses: By spreading out investments over time, DCA reduces the risk of significant losses that could result from investing a large sum just before a market downturn.

- Smoother Returns: DCA can lead to more stable investment returns over time, as it mitigates the impact of short-term volatility and provides a smoother investment experience.

3.2. Builds Wealth Gradually

- Long-Term Growth: DCA allows you to take advantage of long-term market growth while managing short-term risks. Over time, this strategy can contribute to substantial wealth accumulation.

- Compounding Benefits: Regular investments benefit from the power of compounding, as returns on earlier investments can generate additional returns, enhancing overall growth.

4. Accessible for All Investors

4.1. Suitable for Small Investors

- Affordability: DCA is particularly beneficial for investors who may not have a large amount of capital to invest initially. Small, consistent investments can add up over time and provide a solid foundation for growth.

- Accessibility: Many investment accounts, including retirement accounts and brokerage accounts, offer options for DCA, making it accessible to a wide range of investors.

4.2. Flexibility

- Adjustable Contributions: DCA allows for adjustments in investment amounts and intervals based on changes in financial circumstances or goals. You can increase, decrease, or pause contributions as needed.

- Adaptable Strategy: The strategy can be adapted to various asset classes and investment vehicles, including stocks, mutual funds, ETFs, and retirement accounts.

5. Supports Long-Term Investment Goals

5.1. Aligned with Retirement Savings

- Consistent Growth: DCA aligns well with long-term goals such as retirement savings, as it promotes steady contributions over time, which can benefit from long-term market growth and compounding.

- Mitigates Timing Risks: By using DCA, you reduce the risks associated with market timing and benefit from consistent investments over the years.

5.2. Helps Achieve Financial Goals

- Goal-Oriented Investing: DCA supports various financial goals, whether saving for education, a down payment on a home, or other long-term objectives. Consistent investing can help you reach these goals systematically.

Conclusion

Dollar-Cost Averaging offers several benefits for investors, including reduced market timing risk, disciplined investing habits, risk management, and accessibility. By investing a fixed amount regularly, you can smooth out the effects of market volatility, build wealth gradually, and stay aligned with long-term financial goals. DCA is a practical and effective strategy for both new and experienced investors, helping to create a more consistent and manageable investment experience.